tax on forex trading in canada

That works out to a 10 to 20 difference. Learn to Day Trade.

2021 Capital Gains Tax Rates In Europe Tax Foundation

Deducting Losses Unfortunately as a day trader you cannot utilise the 50 capital gains inclusion rate on your profits.

. You do not need to stick to one system forever. As an option people who are not willing to pay income. If youre new to forex you may want to ask about tax implications.

However here you only have to pay. Elija entre las mejores plataformas reguladas y certificadas para operar en Honduras. December 30 2021 admin Leave a.

Modern forex trading has digitized a relatively old method of making money. However you only have to report the amount of your net gain or loss for the year that is more than 200. Is Forex Trading Tax Free In Canada.

Whereas capital gain tax is a generous half of your marginal tax rate. Income tax is taxed at your marginal tax rate. Canada generally charges a tax of 50 of any capital gains.

You just need to apply it consistently to that tax return and not flip-flop systems. The profits or losses you. Do I Pay Taxes For Forex Trading.

Neither capital gains nor losses will be reported on your income tax or benefit returns if the net amount is less than 200. Forex Trading Forex Trading. You can use an average annual rate or the daily rate.

It is the tax you must pay on your Forex trading earnings if you are trading as an investor. 5 rows Is forex tax-free in Canada. If the net amount is 200 or less there is no capital gain or loss and you do not have to.

Contracts for FX futures and options can be purchased using 594. Do I Pay Taxes For Forex Trading. For example assume that you are a Canadian traveler with C10000 in cash.

Httpsbitly36x4Dy1Get my FREE Journal Watchlist. Taxes in Canada is. However you can deduct 100 of your trading losses.

Ad Encuentra las páginas más seguras para comprar acciones y invertir online. 6 rows Taxation on Forex trading in Canada. Forex is taxable only when it is your source of income or.

Yes you pay taxes on it and each transaction for gain or loss doesnt matter if you withdraw the money. The top tax rate of 42 applies to taxable income above 55961. That can be applied to other sources of income as well.

It is necessary to add half of the capital gain to your income if your investment sells for a higher price than what you paid. Traders seeking a career as forex practitioners might want to ask about tax implications. Instead 100 of all profits are taxed at your current tax rate.

Futures and options on the forex market have 1256 contracts and are taxed. Traders Union Announces the Best Forex Brokers in Canada 2021. At the same time 100 of any losses are deductible too.

Finally for taxable income above 265327 a 45 tax is applicable. If you trade foreign exchange or anything else as a profession then your income would be considered regular income and would be taxed at your normal tax rate. It is for those whose main source of business is not Forex trading.

Since it is impossible. When you get to New. Gains made from Foreign exchange will be considered as.

9 Best Forex Brokers In Canada For November 2022

What You Trade Can Make A World Of Tax Difference Green Trader Tax

Forex Trading In Canada Is It Legal Do I Pay Taxes

Best Forex Brokers Canada 2022 Top Canadian Forex Brokers

:max_bytes(150000):strip_icc()/shutterstock_434918776_forex-5bfc31b846e0fb00265d0ee9.jpg)

How To Choose A Forex Broker What You Need To Know

Is Forex Trading Allowed In Canada Earthweb

7 Best Forex Brokers For Beginners In 2022 Forexbrokers Com

Realistic Forex Income Goals For Trading

How To Answer The Virtual Currency Question On Your Tax Return

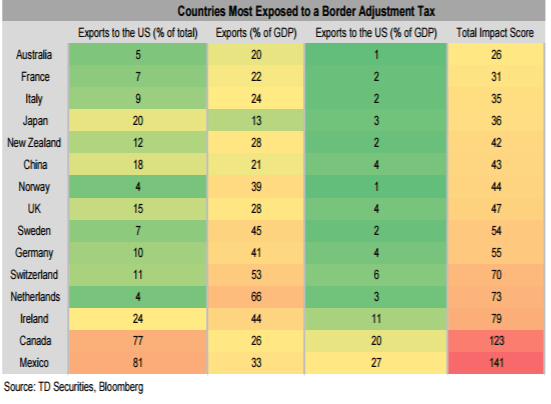

Us Border Adjustments Which Major Currencies Are Most Vulnerable

Which Country Is Best For Forex Trading

Realistic Forex Income Goals For Trading

Tax Tips For The Individual Forex Trader

:max_bytes(150000):strip_icc()/Foreign-currencies-58c5b0253df78c353c57c52f.jpg)

How To Open A Forex Trading Account

Is Forex Trading Legal In Canada Forex Trading In Canada Forex Education

Paul Lam Founding Engineer For Data Driven Enterprise Startups Forex Trading Income Or Capital Gain Tax In Canada

Best Forex Brokers In Canada 2022 Fees Customer Service Safety

Best Forex Brokers Canada 2022 Compare Top Brokers With Low Fees